When you sell or buy a vehicle in Florida, one of the key documents you should understand is the bill of sale for car Florida. A bill of sale records that one party (the seller) transfers ownership of a vehicle (or mobile home, vessel, etc.) to another party (the buyer) under agreed-upon terms. It may not always be the only document required, but it is a critical step in protecting both seller and buyer. Under Florida law, especially the statutes governing titles and transfers, a state of Florida bill of sale for car (or its official equivalent) often complements other mandatory filings.

For example, according to the Florida Highway Safety and Motor Vehicles (FLHSMV), a seller must file a Notice of Sale form to protect themselves from liability after transferring a vehicle. In my legal experience, sellers who skip this step risk remaining responsible for toll violations, parking tickets, or even accidents after they’ve sold the car.

This article — written from my perspective as a licensed Florida attorney — walks you through the legal requirements for creating a valid bill of sale, explains when it’s required or optional, and provides a clear step-by-step guide. You’ll also find a sample free car bill of sale Florida template and learn how to avoid common mistakes that could cause legal or financial trouble later.

This article is for informational purposes only and does not constitute legal advice. For advice specific to your situation, consult a qualified attorney.

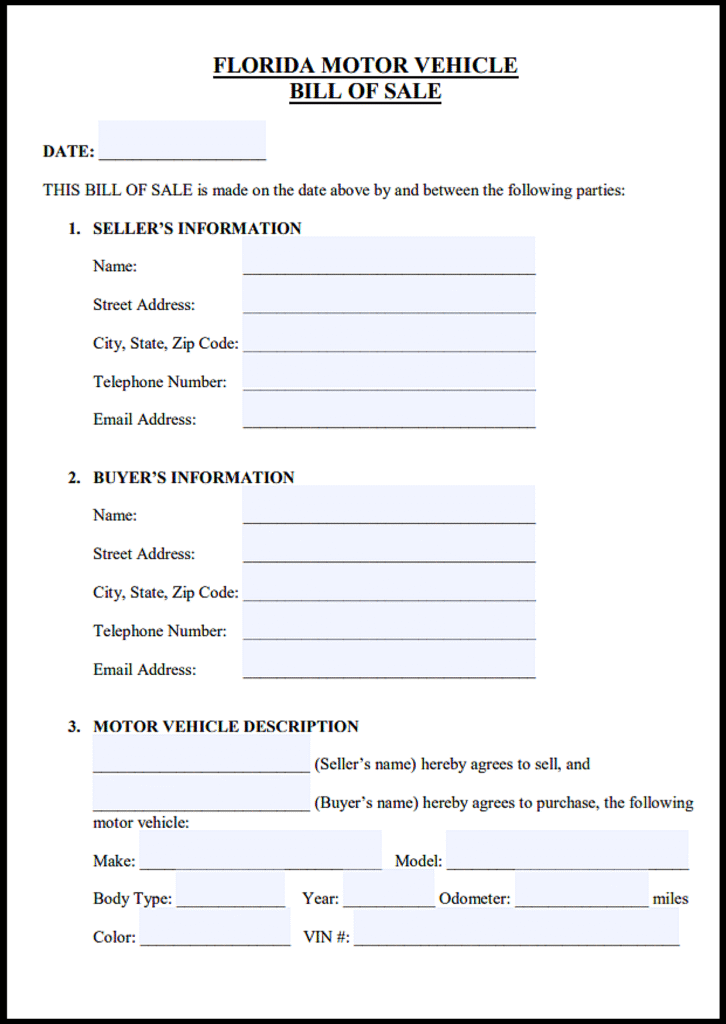

Free Florida Bill of sale For Car Template

Creating a clear and accurate bill of sale doesn’t have to be complicated. To make the process easier, I’ve included a free Florida bill of sale for car template that follows the format accepted by the Florida Highway Safety and Motor Vehicles (FLHSMV). This template helps both the buyer and seller record essential details such as the vehicle’s identification number (VIN), odometer reading, purchase price, and date of sale. In my legal experience, using a properly drafted template helps prevent disputes and ensures both parties meet the documentation requirements under Florida Statutes §319.23 and §319.27. You can download, fill in, and print this form for personal use when completing your private vehicle sale in Florida.

In Florida, license plates usually do not transfer with the vehicle. They stay with the seller and should be removed before the vehicle is delivered. Buyers are responsible for obtaining new registration and plates at the tax collector’s office.

Florida Car Bill of Sale Form

The Florida Car Bill of Sale Form is an essential document that legally records the transfer of ownership of a vehicle from one person to another within the state. It serves as written proof that a sale has taken place — identifying the buyer, seller, purchase price, vehicle details, and the exact date of the transaction. In Florida, this form isn’t just helpful; it’s often necessary to protect both parties and to complete title and registration requirements with the Florida Highway Safety and Motor Vehicles (FLHSMV).

In my experience as a Florida attorney, I’ve seen how properly filling out this form can prevent future disputes or liability issues. Whether you’re buying a used car from a private seller or selling your own vehicle, the Florida Car Bill of Sale Form provides legal clarity and peace of mind. It’s your written safeguard if questions arise later about ownership, payment, or responsibility for tolls and violations.

This article explains what the form includes, when it’s required, and how to complete it correctly under Florida law — so your transaction is secure, compliant, and fully documented.

Florida Car Bill of Sale As is No Warranty

When selling a vehicle privately in Florida, many sellers choose to transfer ownership “as is,” with no warranty. This means the car is sold in its current condition — the buyer accepts any existing or future problems without expecting repairs or guarantees from the seller. A properly worded Florida Car Bill of Sale As Is No Warranty helps make that clear and legally protects both sides.

Under Florida Statutes §672.316, sellers can disclaim warranties if the sale document clearly states that the vehicle is sold “as is” or “with all faults.” Including this phrase in your bill of sale for car Florida ensures that the buyer understands there are no implied promises about the vehicle’s condition or performance.

In my legal practice, I’ve seen many disputes arise simply because this disclaimer was missing or unclear. By using a detailed state of Florida bill of sale for car as is no warranty, you create a written record that limits future liability and sets transparent expectations.

Car Bill of Sale Florida PDF

If you’re selling or buying a car in Florida, having a properly completed Car Bill of Sale Florida PDF is essential. This legal document proves the transfer of ownership between the seller and buyer, showing that both parties have agreed on the terms of sale. The Florida Highway Safety and Motor Vehicles (FLHSMV) recognizes the bill of sale as an important record that helps prevent future disputes or liability issues. Whether you’re completing a private vehicle sale or gifting a car, downloading and filling out a verified Florida bill of sale PDF ensures your transaction is properly documented. In this guide, I’ll explain what details to include, why this form matters under Florida law, and how to use it correctly to protect yourself during a vehicle transfer.If you’re selling or buying a car in Florida, having a properly completed Car Bill of Sale Florida PDF is essential.

This legal document proves the transfer of ownership between the seller and buyer, showing that both parties have agreed on the terms of sale. The Florida Highway Safety and Motor Vehicles (FLHSMV) recognizes the bill of sale as an important record that helps prevent future disputes or liability issues. Whether you’re completing a private vehicle sale or gifting a car, downloading and filling out a verified Florida bill of sale PDF ensures your transaction is properly documented. In this guide, I’ll explain what details to include, why this form matters under Florida law, and how to use it correctly to protect yourself during a vehicle transfer.

Get PDF

Sample Bill of Sale for Car Florida

To help you understand what a proper bill of sale for car Florida looks like, I’ve included a sample layout based on the requirements set by the Florida Highway Safety and Motor Vehicles (FLHSMV). This state of Florida bill of sale for car example shows the key sections every document should include — such as the vehicle’s details, purchase price, buyer and seller information, and signatures.

In my legal practice, I always advise clients to review their bill of sale carefully before signing. Even small errors — like a missing Vehicle Identification Number (VIN) or incorrect sale date — can cause registration delays or legal disputes later. This free car bill of sale Florida sample provides a simple and compliant starting point that you can adapt to your transaction.

Florida Bill of Sale Gift Car

If you’re planning to gift a car in Florida, you’ll still need proper paperwork — and that includes a Florida Bill of Sale for Gift Car. Even though no money changes hands, the state still requires documentation to officially record the transfer of ownership. This ensures both parties — the giver and the recipient — are protected and that the title and registration are properly updated under Florida law.

In my legal experience handling vehicle transfers, I’ve seen many people assume that a gift doesn’t require a bill of sale. However, under Florida Statutes §319.23 and §319.27, every title transfer — whether by sale, trade, or gift — must be reported to the Florida Highway Safety and Motor Vehicles (FLHSMV). The bill of sale serves as proof that ownership was transferred legally and voluntarily, even when no payment was made.

When a Gift Is Exempt From Sales Tax

A gifted vehicle is generally exempt from sales tax when the transfer is between qualifying immediate family members. Most Florida tax collector offices recognize the following as exempt relationships:

-

Spouses

-

Parent ↔ Child

-

Grandparent ↔ Grandchild

-

Siblings (in many counties, proof of family relationship may be required)

To qualify, the recipient typically must file an affidavit of familial relationship or a similar tax exemption form provided by the local tax collector. Some counties require a notarized affidavit.

When Sales Tax Applies to a Gift

If a vehicle is gifted outside of qualifying family relationships (for example, to a friend, business partner, cousin, or boyfriend/girlfriend), most counties treat the gift like a taxable transfer.

In these cases, sales tax may be calculated based on:

-

Fair market value of the vehicle, or

-

The bill of sale stating “Gift – $0” accompanied by valuation review by the tax office

The tax collector’s office has authority to dispute the declared value if it does not reflect market value.

Documentation Required for a Gift Transfer

Even when tax is not due, the following are typically required:

-

A completed bill of sale indicating “gift” or $0 value

-

A correctly signed title transfer

-

Notice of Sale (Form HSMV 82050)

-

Proof of relationship (IDs, birth certificates, marriage certificate, or affidavit)

-

Florida insurance (required before registration)

Important Legal Note

A gift should be voluntarily given and clearly documented. A misleading bill of sale (e.g., writing “gift” to avoid tax when payment occurred) may result in penalties or additional tax assessments.

In my legal practice, I advise clients to always document the gift clearly and attach a relationship affidavit to the title application. This avoids disputes at the tax collector’s office and prevents delays in issuing the new title.

As is Bill of Sale Florida Car

When you’re buying or selling a car in Florida, one of the most important documents you’ll need is the Bill of Sale Florida Car. This document serves as a written record that ownership of a vehicle has legally transferred from the seller to the buyer. It includes essential details such as the purchase price, vehicle identification number (VIN), odometer reading, and both parties’ information.

Under Florida law — specifically Florida Statutes §319.23 and §319.27 — the bill of sale works alongside the title transfer process to protect both parties in the transaction. It provides proof of the sale, helps prevent disputes, and can be used for tax and registration purposes with the Florida Highway Safety and Motor Vehicles (FLHSMV).

In my legal experience as a licensed Florida attorney, I’ve seen many sellers overlook the importance of completing this form correctly. A properly executed bill of sale can protect you from liability for future toll violations, parking tickets, or even accidents that occur after the car has been sold.

This guide explains everything you need to know about the Florida car bill of sale — including when it’s required, how to complete one step-by-step, and common mistakes to avoid. You’ll also find a simple example and a downloadable template to make the process easier.

Also Check: For Vehicle | Motorcycle | Automobile | DMV | Trailer | Vessel | RV | Blank | Simple | PDF | WORD

What is a Bill of Sale in Florida?

A bill of sale in Florida is a written document that evidences the transaction of a motor vehicle (or mobile home, off-highway vehicle, vessel) from a seller to a buyer for consideration (money or other value). In practical terms, it shows the date of sale, parties involved, description of the vehicle (make, model, year, VIN), sale price, odometer reading (for motor vehicles), and signatures of seller and buyer.

Under Florida statute Florida Statute § 319.23, the application for a certificate of title “must be accompanied by … a proper bill of sale or sworn statement of ownership, or a duly certified copy thereof…” when a vehicle has not previously been issued a title in this state.

Similarly, under § 319.27, the statute governs notices of lien and notation on certificates of title, which indirectly highlight the importance of clear transaction documentation when ownership changes.

In my practice I often tell clients: think of the bill of sale like the receipt for a private‐party vehicle sale. It helps lock in the terms and provides proof that the vehicle changed hands.

Is a Bill of Sale Required in Florida?

When it is mandatory

Although Florida does not always require a separate bill of sale in every vehicle transfer, there are specific scenarios where the law mandates documentation equivalent to one:

-

If the vehicle has never had a Florida certificate of title issued (for example an out-of-state vehicle being titled for the first time), § 319.23(3) states the application must be accompanied by “a proper bill of sale or sworn statement of ownership”.

-

When a seller wants to protect themselves from liability after the sale, the FLHSMV’s consumer guidance states that “as of July 2009, Florida law requires all sellers to file a Notice of Sale” (Form HSMV 82050) which is essentially a notice of sale or bill of sale.

When it is optional (but strongly recommended)

-

For many standard private vehicle sales within Florida, the title certificate’s reassignment section may suffice to transfer ownership. However, having a separate bill of sale provides stronger evidence of the transaction, price, and odometer reading.

-

If you are transferring a vehicle as a gift (no money exchanges hands) between family members, you may not strictly need a ‘traditional’ bill of sale for sale for consideration, but you still need documentation of the transfer (and you may need to indicate “gift” status on the title application). Having a bill of sale or written statement helps clarify the status.

-

Even when not strictly required, if there are future disputes (for example about payment, condition, or mileage), a well‐drafted bill of sale helps protect both parties.

In my experience, I advise clients: when in doubt, complete a bill of sale and file the Notice of Sale with the FLHSMV. That way you reduce your risk of being the “owner on paper” after the sale.

Step-by-Step Process to Complete a Bill of Sale

Below is a typical workflow for a private vehicle sale in Florida, and how the bill of sale fits in:

-

Seller and Buyer negotiate terms – Agree on sale price, vehicle condition, date of transfer, any included items (e.g., title, plates, accessories).

-

Seller verifies title and liens – Seller should ensure the vehicle’s title is clear, no outstanding liens (or that they will be satisfied). If there is a lien, it must be released before or at closing. The statutes covering lien notation on title: § 319.27.

-

Complete the bill of sale (and/or FLHSMV Form 82050) – This document should include:

-

Full legal names and addresses of seller and buyer

-

Date of sale

-

Vehicle description: year, make, model, body type, color, VIN (Vehicle Identification Number)

-

Sale price (consideration)

-

Odometer reading at time of sale (for motor vehicles)

-

Statement of “as-is” if no warranty is given (private sale)

-

Signatures of seller (and buyer, if desired).

-

-

Seller completes the title reassignment – On the front of the Florida certificate of title (if paper) the seller must complete the “Transfer of Title by Seller” section: buyer’s name and address, odometer reading, sale price, date sold, seller’s signature. The buyer then applies to the FLHSMV or local tax collector for the new title.

-

Seller files a Notice of Sale (Form HSMV 82050) – The seller should promptly file this with their local tax collector or service centre, so their registration is removed and they are not liable for future events involving the vehicle. FLHSMV emphasises this step.

-

Buyer applies for certificate of title/registration – The buyer must apply to the FLHSMV or local tax collector (via Form 82040 or appropriate title application) within 30 calendar days of the sale to avoid penalties. § 319.23(6)(a) provides the 30-day requirement.

-

Both parties keep copies – The seller and buyer should each retain a signed copy of the bill of sale, the title reassignment, and any notice of sale filings. These documents are valuable if future disputes arise.

In my legal practice I find that skipping the Notice of Sale is a common mistake sellers make; even though the title is reassigned, without the notice filed they may still appear as the owner in FLHSMV records and face potential liability.

Key Legal Requirements

Vehicle Identification Number (VIN)

-

The bill of sale must identify the vehicle by its VIN, alongside make, model, body type, year and colour. Without this, the document may not sufficiently identify the vehicle and could be challenged.

-

Under § 319.23(3)(c), for vehicles previously outside Florida, the application for title must show last registration details and VIN.

-

Under § 319.33, altering or defacing a VIN is unlawful.

Odometer Disclosure

-

For motor vehicles (not necessarily trailers or mobile homes) a seller must disclose the odometer reading at the time of sale. The Form HSMV 82050 (bill of sale/notice of sale) includes an odometer statement.

-

Also, § 319.225 requires the certificate of title to contain an odometer disclosure statement (for vehicles subject to federal odometer law).

-

In my practice I emphasise: double-check the odometer reading, get the buyer to initial it, and keep the mileage value clearly stated in the bill of sale.

Notary or Witnessing

-

Florida does not always require notarisation of a bill of sale for a vehicle sale. However, notarisation adds a layer of protection (especially when amount is large or parties are out-of-state).

-

The FLHSMV consumer guidance suggests the bill of sale “may be notarized” although not strictly mandatory.

-

If a lien or reassignment is involved, the notarised signature may simplify proof of authenticity in future legal problems.

Tax Collector / Title Office Filing

-

The buyer must apply for the new title/registration within 30 calendar days of the date of sale, under § 319.23(6)(a).

-

For the seller, filing the Notice of Sale form (HSMV 82050) with the local tax collector removes their liability for the vehicle.

-

If the vehicle has a lien, the lien must be satisfied and lienholder must forward satisfaction notice to FLHSMV within 10 days. § 319.27(5)(a)–(b) covers this.

Sales Tax & Registration Fees

-

The sale price on the bill of sale is used by the tax collector to determine sales tax and registration fees. For vehicles purchased in Florida, sales tax typically applies unless exempt (gift, family transfer, etc.).

-

The buyer should be aware that the sale price stated on the bill of sale must reflect true consideration; undervaluing the vehicle may lead to issues with the county tax collector.

Example or Template

Below is a sample layout for a valid Florida vehicle bill of sale. Use this as a guide — adapt dates, names, and details to your transaction.

Bill of Sale

This Bill of Sale is made on [Date] by and between Seller: [Full Legal Name], [Address, City, State, ZIP] and Buyer: [Full Legal Name], [Address, City, State, ZIP].

Vehicle Description

Year: [YYYY]

Make: [Make]

Model: [Model]

Body Type/Color: [Body Type / Colour]

VIN: [Vehicle Identification Number]

Current Title Number: [if available]

Odometer Reading (no tenths): [_____] miles

(Check one) ☐ Actual mileage ☐ Exceeds mechanical limits ☐ Not actual mileage

Sale Terms

Consideration (Sale Price): $[Amount]

Date of Sale: [MM/DD/YYYY]

Place of Sale: [County], Florida

Warranty & Liens

The seller warrants that they are the lawful owner of the vehicle, that the vehicle is free of any undisclosed liens (unless noted below), and that they have the right to convey it.

☐ There is a lien held by [Lienholder Name] with lien satisfaction required by [Date].

The vehicle is sold “AS-IS” and the buyer acknowledges that no express warranties are given except as noted herein.

Signatures

Seller’s Signature: ______________________ Date: _______

Seller’s Printed Name: ____________________

Buyer’s Signature: _______________________ Date: _______

Buyer’s Printed Name: _____________________

Optional Notary Section

State of Florida

County of _____________

On this ____ day of ______, 20, before me, _________, personally appeared [Seller Name] who is personally known or produced identification _______ and acknowledged the execution of this document.

Notary Public, State of Florida

My Commission Expires: __________

In practice I provide clients with the official FLHSMV form HSMV 82050 (Notice of Sale or Bill of Sale) which incorporates many of the above fields.

Download a template, fill it out, print two copies (one for each party), and keep copies with the title documentation.

Common Errors or Legal Pitfalls

In my legal practice handling vehicle transactions I frequently see the following mistakes — you’ll want to avoid them:

-

Not filing the Notice of Sale (HSMV 82050): Seller remains liable for tolls, fees, accidents or tickets after the sale if their name remains on FLHSMV’s records.

-

Incorrect or missing odometer reading: Mistakes here trigger federal disclosure laws and may expose seller to liability. § 319.225 addresses odometer disclosure.

-

No VIN or incorrect VIN in the bill of sale: Makes it hard to prove the transaction or tie it to the correct vehicle.

-

Sale price omitted or understated: Impacts tax calculation and may raise questions with the county tax collector.

-

Lien not satisfied or not disclosed: If a lien remains and the buyer fails to note it, both parties can face complications. § 319.27 covers lien satisfaction timing.

-

Buyer fails to apply for title/registration within 30 days: Under § 319.23(6)(a), the buyer must apply within 30 days to avoid penalty.

-

Seller transferring plates incorrectly: In Florida, plates generally stay with the seller, not automatically with the vehicle. FLHSMV guidance emphasises removal of seller’s plates.

-

No written condition “as-is” when applicable: Since private sales rarely include warranties, failing to specify “as-is” may open liability.

-

Poor record-keeping: Not keeping duplicates of signed documents, misplacing copies, or relying solely on verbal agreements.

When I advise clients, I always emphasise: get everything in writing, execute on the day of sale, file notice promptly, keep copies. That way you minimise future disputes and liability.

FAQs

Do I need to notarize the bill of sale?

Generally no — Florida law does not require notarisation of every private vehicle bill of sale. However, notarisation is advisable for added proof of identity and voluntariness, especially in higher-value transactions.

If I gift a car to a family member, do I still need a bill of sale?

While “sale for consideration” may not apply, you still need to document the transfer and indicate “gift” status to handle tax implications. A bill of sale or written statement helps. Additionally, the title application must reflect gift status for possible tax exemption.

What if I lost the title but sold the vehicle?

The seller must apply for a duplicate title and the buyer must be aware the sale is subject to a duplicate title. The bill of sale remains important. The statute § 319.23(7) provides for bond and affidavit when title cannot be produced.

Can I use the FLHSMV Form 82050 instead of a separate bill of sale?

Yes — Form HSMV 82050 is designed as a Notice of Sale and/or Bill of Sale for a motor vehicle, mobile home, off‐highway vehicle or vessel. It is accepted by FLHSMV and tax collectors.

Alexander Nobregas, Esq.

Florida Attorney & Legal Documentation Specialist

Alexander Nobregas is a licensed attorney based in Florida, United States, focusing on consumer law, property transfers, and legal documentation. He has extensive experience helping Florida residents navigate private sales, title transfers, DMV requirements, and ownership verification issues.

Through BillofSaleFlorida.com, Alexander provides clear, accurate, and practical guidance on bills of sale and Florida compliance rules—making legal processes easier for everyday buyers and sellers. His articles are based on real-world cases, Florida Statutes, and years of hands-on legal experience.

![Bill of Sale Florida For Car, Vehicle [Edit & Printable] PDF](https://billofsaleflorida.com/wp-content/uploads/2025/11/cropped-Bill-of-sale-florida-logo-160x74.png)